Non-fungible tokens, or NFTs, have been making waves in the investment world. However, like any investment, they come with their own set of advantages and disadvantages. Here’s a closer look at the pros and cons of investing in NFTs.

The Pros of Investing in NFTs

One of the key benefits of investing in NFTs is that it is open to everyone. The process of tokenizing assets into NFTs has made it possible for anyone, anywhere in the world, to invest in these digital assets.

Another advantage is the security offered by blockchain technology. When an asset is tokenized into an NFT, its ownership is secured on a blockchain, providing a transparent and secure record of ownership. This digital signification of ownership can enhance the security of an investor’s assets.

Moreover, investing in NFTs provides an opportunity to learn more about blockchain technology. By allocating a small sum to tokenized assets, investors can gain knowledge about this revolutionary technology while diversifying their portfolios.

The Cons of Investing in NFTs

Despite the potential benefits, there are also significant drawbacks to investing in NFTs. One common misconception is that NFTs are an asset class in themselves. In reality, NFTs are a technological means of indicating ownership, not an asset class. This misunderstanding, coupled with the hype surrounding NFTs, can lead to inflated and volatile values of tokenized assets.

Another major concern is the high energy consumption associated with NFT generation. Most NFTs are supported by the Ethereum blockchain, which uses an energy-intensive operating protocol called proof of work. A single NFT transaction can consume as much electricity as an average home does in about a day and a half.

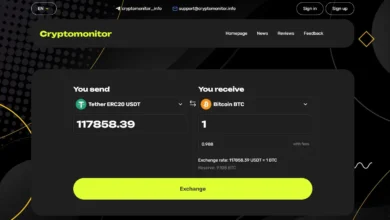

Additionally, to purchase an NFT, one may need to own Ether (ETH), the native currency of the Ethereum platform. This requirement could limit options for investors wishing to buy NFTs with fiat money like the U.S. dollar.

The Bottom Line

While NFTs offer unique opportunities, it’s crucial to remember the fundamentals of investing. It’s not advisable to invest in an asset solely because it’s tokenized. As an investor, your primary focus should be identifying quality assets that you’d like to own and understanding the risks associated with your investments.

Frequently Asked Questions (FAQs)

Are NFTs a Good Investment?

Investing in an asset just because it’s tokenized into an NFT is not a wise decision. NFTs themselves are not investments. Therefore, it’s essential to understand the value of the underlying asset before purchasing the NFT.

Should You Invest In Non-Fungible Tokens (NFTs)?

Investing in NFTs is not inherently bad. If you identify an appealing asset and have the necessary funds, you might consider buying it. However, it’s crucial to understand the risks associated with NFT investing.