In the rapidly changing world of cryptocurrencies, user privacy and freedom of choice have become critical topics. The emergence of crypto exchanges without Know Your Customer (KYC) requirements is one of the most debated innovations in the given space. On these platforms, the users can trade digital assets without undergoing conventional identity verification processes.

Why Traders Choose No-KYC Exchanges

Many users value their privacy. Traditional KYC processes usually involve the provision of sensitive documents, including passports, ID cards, or utility bills. This creates risks of data leaks, hacking, and identity theft. No-KYC exchanges do not have such a barrier because they are faster to register and have a higher degree of anonymity.

For traders living in countries with strict financial regulations, such exchanges may also represent one of the few available options for accessing the global crypto market.

Benefits of No-KYC Platforms

- Privacy and Anonymity: Personal data is not collected, reducing risks of exposure.

- Faster Transactions: Users can start trading immediately, without waiting for approval.

- Global Accessibility: No-KYC exchanges often accept users from regions that face restrictions on traditional platforms.

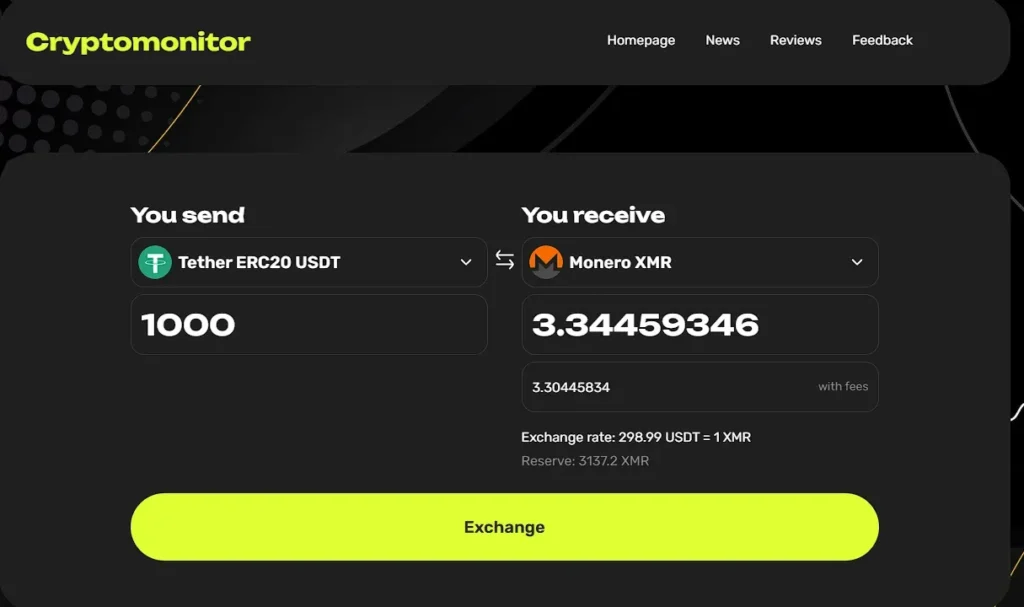

- Support for Privacy Coins: Many such services allow trading of coins like Monero (XMR), Zcash (ZEC), and others, reinforcing anonymity.

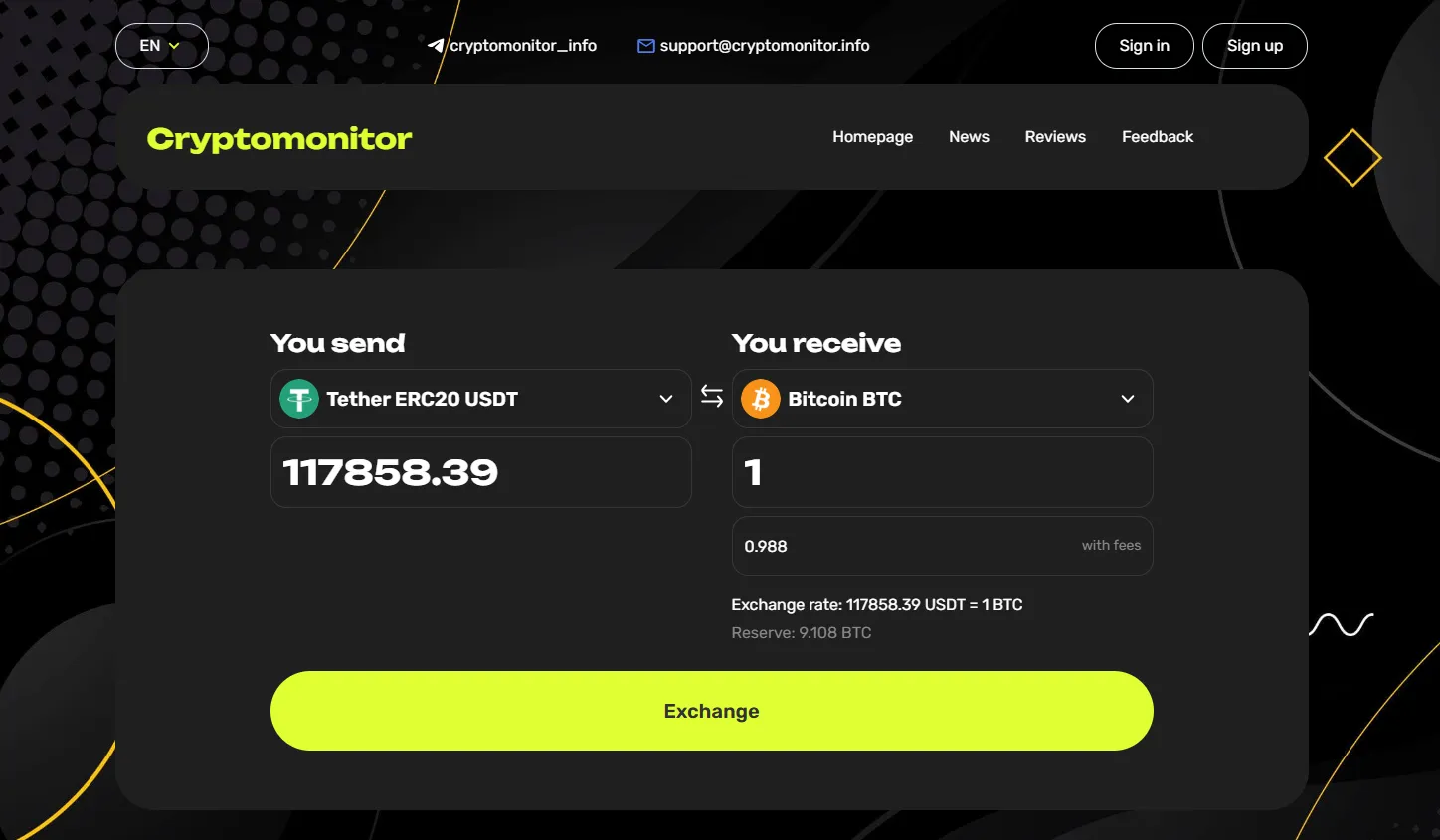

A Practical Example: CryptoMonitor.info

One notable platform in this area is CryptoMonitor.info, a crypto-to-crypto exchange aggregator that focuses on anonymous and secure swaps. It does not require KYC or a non-custodial transaction to be fast, unlike many centralized services, and allows privacy-friendly coins like Monero (XMR) to be adopted.

Transparency, reasonable rates, and feedback are the key factors of the project that can be adopted by individuals who desire to keep their data in their hands and be able to enter the global crypto market.

Risks and Considerations

However, choosing a no-KYC exchange requires caution. Since these platforms do not follow standard verification procedures, users should closely consider their reputation, liquidity, and security measures. The platform should have a clear track record, community feedback, and good technical protection.

Moreover, regulators on a global scale are paying more attention to the anti-money laundering (AML) regulations. Without a requirement to know your customer, the provision of such no-KYC exchanges can fluctuate with time, based on jurisdiction and compliance.

The Future of No-KYC Exchanges

Despite regulatory pressure, the demand for anonymous trading solutions is unlikely to disappear. As the crypto industry evolves, we may see hybrid models that balance user privacy with security standards.

For now, no-KYC exchanges and aggregators like CryptoMonitor.info could be crucial solutions to individuals who place premiums on anonymity, speed, and global access. Misuse When using such platforms, users need to keep in mind the significance of research, security measures, and personal accountability.