Futures contracts are agreements to deliver a specific asset on a future date, such as stocks, goods, or raw materials. The contract value is tied to the value of the underlying asset. They are useful for businesses as they provide a secure price for the item and protect against price increases. Futures contracts can be purchased or sold, with the buyer agreeing to pay a specific amount on a set date.

Futures cover a range of assets, including currency, stock indexes, precious metals, and commodities such as wheat and crude oil. Options contracts offer the right to sell or purchase the underlying asset before the contract expires. Futures contracts require a deposit of only a portion of the contract value, and businesses can use them to hedge against price fluctuations. Investors can also use futures contracts to speculate on the asset’s future price, but this involves the risk of losing more than the initial investment.

How Do They Work?

Futures markets are known for allowing traders to trade with more than 100% of the contract’s value while engaging in a transaction. The broker would want a percentage of the contract value as an initial margin. The exchange where the futures contract trades will determine whether the transaction is for physical delivery or can be settled in cash. Businesses may enter into a physical delivery contract to secure the price of a commodity needed for manufacturing, but many futures contracts contain speculators speculating on the transaction. These contracts are settled in cash once closed or netted (the difference between the initial deal and the closing trade price).

Final Takeaways To Get Started

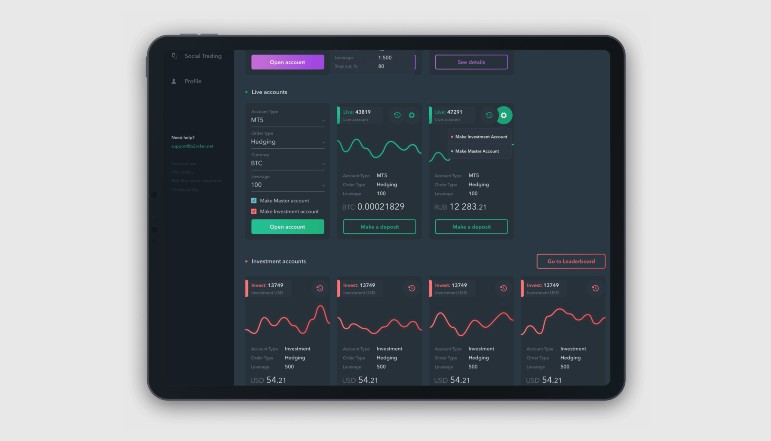

One key takeaway from this book is that beginning to trade futures is easy. Simply open an account with a broker who offers the markets you’re interested in. Keep in mind that fee and charge structures vary between brokers in the futures industry. Before making your first real transaction, you can test your knowledge of futures markets, leverage, and fees by practicing with “paper money.”