Stock trading is a place where being ahead of the market trend is very crucial to the best returns and risk mitigation. Previously, trading practitioners were dependent on traditional approaches such as technical analysis, instinct, and expert opinions. The concept of artificial intelligence has brought about a new, smarter phase of trading.

Stockity represents a major advancement because the platform is AI-driven. With AI at its core, Stockity has become a tool that will help traders with their analysis and decision-making and set the stage for the future of trading.

AI: The Game-Changer for Traders

The influence of AI is quite noticeable in trading scenes, as it is the main reason behind fast and precise decision-making. Human traders used to rely on personal judgment to read charts or interpret market news, which was the traditional nature of trading.

Stockity’s algorithms are faster and work with real-time data, thereby giving the platform the ability to recognize any likely patterns, trends, or signals that human traders may overlook. Moreover, using advanced machine learning methods, Stockity gives traders valuable insights to strengthen their decision-making process.

Stockity’s AI system is not limited to analyzing historical data only; it is also capable of recognizing market sentiment, social media, and breaking news to present a clear and concise picture of the market.

This analysis is very in-depth and will give traders the tools to make the right decisions, resulting in a higher level of success in a market that might well be called “volatility personified.”

Real-Time Data and Insights

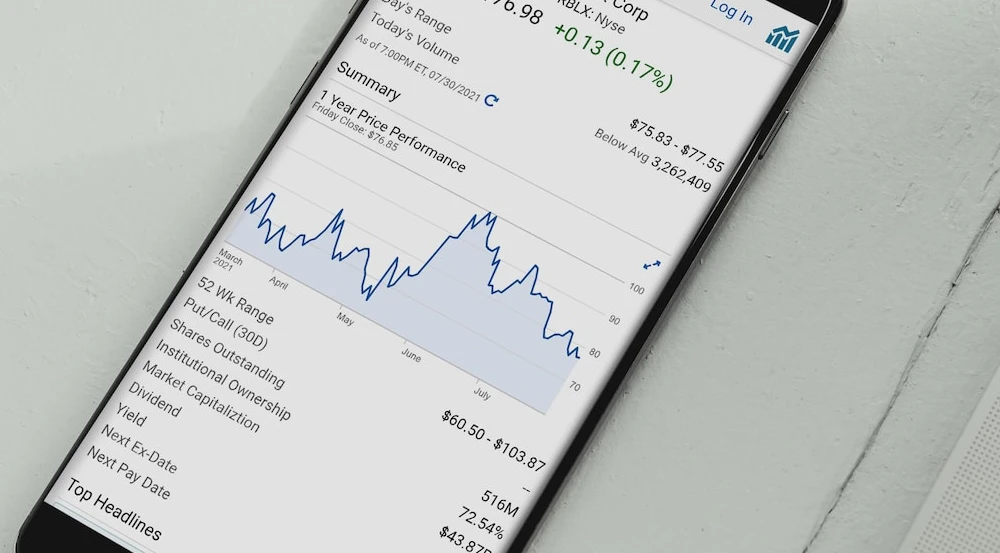

Stockity trading is really about the timing. As the prices are evolving so fast, being knowledgeable and reacting in time can make a lot of difference. Through an AI-fueled platform, Stockity provides real-time data and insights that keep you updated on the latest market conditions.

Stockity deals with processing data in real time and accelerates market trades. Whether you want to grab an opportunity to buy when the price of a stock is low or sell the stock before the price goes down, access to instant data is very beneficial to your trading life. You can be well ahead of the curve, thus making decisions faster and more confidently.

Predictive Analytics: Know What’s Coming

One of the best features of Stockity is its ability to make predictions. By utilizing machine learning algorithms, Stockity is able to foresee stock price movements and market trends by analyzing a wide range of factors, including historical data, market conditions and real-time news.

With Stockity, for example, it is possible to forecast how a particular stock will behave in the face of an imminent earnings report or a major news event. Traders can decide whether to be aggressive or defensive when playing.

Traders can make tactical moves rather than just wait-and-see passive moves, and get to know the trends themselves. As they can forecast the market and capitalize on the opportunities, traders always keep ahead of other traders and earn their bucks at the very beginning of others.

Personalized Strategies for Every Trader

Without a question, every trader looks at risk, has different goals, and has different trading styles. Stockity acknowledges this and hence promotes the personal approach, thus giving customers what they need individually the most.

After you have signed up, Stockity uses the information that you have provided, such as your trading preferences, your risk appetite, and your financial goals, so that a strategy can be outlined to fit your needs.

Stockity’s AI can also develop a strategy that can reach your goals, whether they are to get quick profits or not. Stockity makes sure you are working towards the goals you have set by linking your trades with your own unique objectives and thus avoiding random advice. This approach empowers you to eventually win better, not just at that moment or over a short period of time, by clearly defining your niches.

Risk Management: Protect Your Portfolio

In trading, handling risk is as critical as boosting revenue. Stockity’s AI-powered platform is at your service to give you round-the-clock risk management services. It is wall-to-wall watching of your portfolio that the platform does, which can immediately disclose any market threats, e.g. price volatility or negative public sentiment about some stocks.

You can also enable automated risk management, such as a stop-loss order, when trading with Stockity. Such a feature will ensure that the trade executions are done automatically if a stock goes below a defined price, thus limiting the loss. To be updated about market risks, Stockity is always instrumental in helping you to stay safe from any looming financial doom.

Automation: Trade Smarter, Not Harder

According to an old adage, the least work possible to get the job done is the best. Stockity has focused on working smartly in traditional time-consuming trading tasks. One of Stockity’s best features is its set of automation tools.

Trading requires much time, but Stockity makes it easy by automating certain actions. You can allow Stockity to trade on your behalf by giving it pre-set conditions. Such trades could enable you to react in real-time to market developments without going through all that tiring monitoring.

For instance, once the price of a stock is at a certain level, Stockity will quickly buy it for you. Furthermore, without any action on your part, if a stock attains your profit target, it will be sold automatically.

User-Friendly Interface for All Experience Levels

Even though Stockity uses high-quality technology, the UI/UX has been designed to be as user-friendly as possible so that anyone, no matter how much experience they have in trading, can handle it.

The platform’s simple, decent dashboard is where you manage your portfolios, observe market trends, and make trades. Regardless of your trading experience, from novice to expert, Stockity’s interface delivers the service of driving your ease-of-use and trading potential to the max.

Conclusion

Stockity is opening the door to the future of trading with AI-powered tools, giving traders a smart and more efficient way of trading through the stock market.

By the aid of artificial intelligence, Stockity makes available such real-time data, predictive analytics, personalized strategies, and a highly evolved set of risk management tools, enabling traders to reach the peak of human trading potential by making informed, data-driven decisions.

Stockity’s sophisticated tool is there to help you enhance your trading strategies and secure your investments, whether you are a veteran trader or relatively new to the field. Stockity also means not just the standard of trading; it also refers to the intelligence of trading. Grab the futuristic trading system now and be the winner using Stockity’s AI.”