Non-fungible tokens (NFTs) have become a popular medium for digital art, with people bidding thousands to own these unique collectibles. Some NFTs are even selling for millions. If your loved ones are into digital art and cryptocurrencies and are enticed by the possibility of striking it rich with a speculative investment, then gifting them non-fungible tokens could be a great option.

What Are NFTs?

NFT stands for non-fungible token. Non-fungible means that the item is unique and cannot be easily traded with something else. Unlike fungible items, which can be exchanged for another good or asset of the same value, non-fungibles don’t work this way, as each one is different.

An NFT is essentially a digital file that comes with ownership rights. Anything in digital format can qualify, including pieces of art, sports cards, memes, videos, and audio. Once “tokenized,” they can be bought and sold online.

How to Gift an NFT

There are several NFT marketplaces online, each functioning slightly differently, including in terms of what assets they trade. Some sell a bit of everything, while others specialize in certain niches, such as sports and gaming.

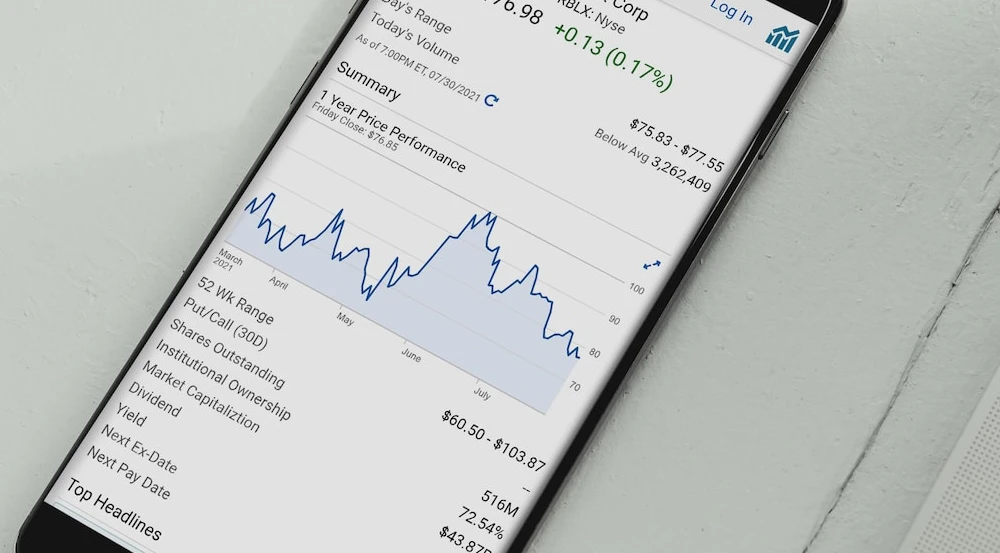

Once you’ve found a suitable marketplace and obtained all the right tools to trade, it’s time to set up an account and start buying. NFT marketplaces operate similarly to eBay. Usually, there are auctions where the highest bidder wins, although some offer “buy now” options where NFTs are sold for a fixed price.

After you’ve made your purchase, the next step is to transfer the NFT to the person to whom you want to gift it. Many NFT marketplaces now offer this option, and it can usually be achieved with a few clicks of a button. Generally, you’ll need to select the item you want to gift, choose the option to transfer it, then key in the recipient’s wallet address.

When gifting an NFT, make sure that you input the recipient’s wallet address correctly. This is a blockchain transaction, meaning that the transfer is irreversible and carries a gas fee—a payment made to compensate for the computing energy required to process and validate transactions on the Ethereum blockchain.

NFT Tax Considerations

Gifts surpassing $16,000 in the calendar year 2022, or $17,000 in 2023, are taxable events in the eyes of the Internal Revenue Service (IRS)—unless the recipient is your spouse. If you plan to be this generous and risk exceeding the lifetime gift tax exemption, then you might be hit with a hefty tax bill.

If that’s not an issue, then the only tax liability will lie with the recipient when they eventually decide to sell. NFTs, like stocks, are subject to capital gains taxes. So, for example, if you bought an NFT for $500 (your cost basis) and the recipient then sold it for $1,000, the donee would be taxed on a capital gain of $500.

Given the newness of NFT taxation, it’s probably a good idea to get in touch with a tax advisor before buying and gifting NFTs.

The Bottom Line

NFTs are digital collectibles that have become a popular form of investment or gifts. However, because they are based on blockchain networks, it is important to understand how the technology works before giving it away. Make sure that the recipient understands the security risks and costs associated with blockchain transactions so that they are able to enjoy your gift.