The Tax Registration Number (TRN) is an essential requirement for businesses operating in the United Arab Emirates (UAE). This 15-digit number is obtained after registering for Value Added Tax (VAT) and serves as a unique identifier that sets a business apart from others.

It also provides a snapshot of a company’s financial status through the invoices they issue during a specific period. This article will guide you through the process of applying for a TRN number in UAE.

What is TRN Number in UAE

In accordance with Dubai laws, every business must register for VAT, for which they need to obtain a TRN number. The TRN helps tax authorities differentiate businesses, especially when it comes to tax payments and VATs.

The mandatory threshold for TRN registration is approximately AED 375,000. If a business’s revenue is expected to exceed this amount in the next month or has exceeded it in the past 12 months, the company must mandatorily register for VAT to avoid hefty fines and penalties.

Eligibility for TRN in UAE

Every business operating in UAE must comply with state laws such as VAT. To be eligible for VAT registration and a TRN, a company must fulfill certain revenue requirements. The voluntary threshold for VAT and TRN registration is 187,500 AED. If a business’s revenue is above 187,000 AED but less than 375,000 AED, the company can choose to register for VAT. However, if a business’s revenue is lower than 187,500 AED, it doesn’t need to register for VAT.

How to Apply for a TRN Number in UAE

Applying for a TRN number in UAE involves an easy online process:

- Visit the FTA website and click on the “Sign Up” option.

- Fill in the sign-up form mentioned on the next tab.

- An email will be sent to your email address to begin the registration.

- Confirm your email and then log in to the e-service account.

- Click on the “Register for VAT” in your dashboard.

- Navigate the ‘Getting Started Guide’.

- Click on “confirm you have read the getting started guide”.

- Click on “Proceed”.

- Fill out the form containing eight sections to apply for your TRN number.

Required Documents for TRN Registration

To get a TRN number in UAE for your business, you need to provide the following documents:

- Company’s Memorandum of Association (MoA)

- Company’s trade license

- Import or export declarations

- Company Bank Account Details

- Company’s turnover declaration letter

- Company’s contact details and address

- Emirates IDs of the shareholder/manager

- Passport copies of the shareholder/manager

- Last Year’s income statement and bank details

- Sample invoices from the suppliers and customers

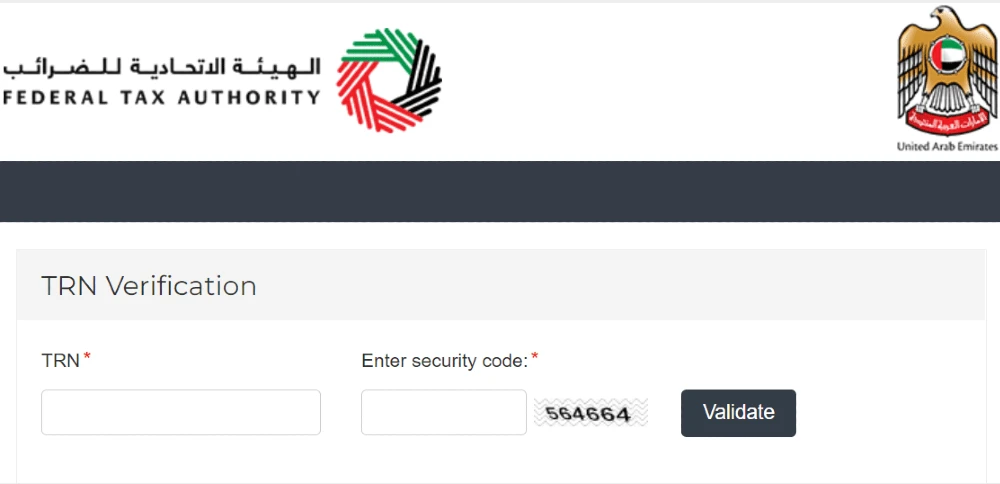

Verifying Your TRN Number in UAE

Once you have your TRN, you can verify its validity through the Federal Tax Authority portal. Here’s how:

- Visit the FTA website.

- Enter the TRN in the space provided.

- A space will be shown where you will have to enter the security Code.

- Tap on the ‘Validate” button.

- The portal will display the Legal Name of the business as well as TRN if it is registered and valid.

Conclusion

Obtaining a TRN number in UAE is a crucial step for businesses to ensure compliance with UAE laws. While the process may seem daunting, expert tax consultants like Avyanco can simplify the process and ensure timely registration of your TRN. With their professional assistance, you can focus on growing your business uninterruptedly.