Cryptocurrencies have become a popular gift choice, thanks to their increasing acceptance and speculative nature. Here’s how you can gift these digital assets.

Gift Cards

Several websites offer cryptocurrency gift cards. Choose a reputable site with positive reviews that offers the cryptocurrency you wish to gift. After selecting the amount and making the payment, you’ll receive a gift card equivalent to the deposited amount. The recipient can redeem the gift by entering the card details on the same website.

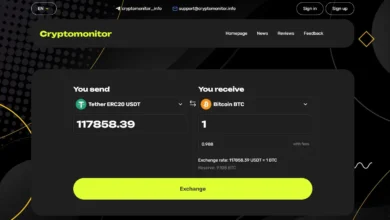

Crypto Exchanges

Gifting cryptocurrency via an exchange is another option. First, choose an exchange, set up an account, and decide on a payment method. Once done, you can send the purchased digital currencies to the recipient’s wallet address.

Storing Cryptocurrencies

After purchasing the gift, it’s crucial to store it safely. While you can hold it on the platform where it was purchased, it’s generally safer to move it offline to prevent hacking and theft.

Paper Wallets

Paper wallets are a cheap method to store cryptocurrencies offline. They contain the key codes needed to access your cryptocurrencies and facilitate transactions. However, they are easily damaged and lost, so it’s best to use them as a temporary storage method until you can transfer the keys to a hardware wallet.

Hardware Wallets

Hardware wallets are USB drive devices that are small, waterproof, virus-proof, and considered the safest way to store cryptocurrencies. They are offline, making them harder to hack than a computer or smartphone.

Physical Coins

For a fancier gift, consider buying or creating physical coins with the key printed on them. These coins are custom-printed on a three-dimensional printer using metal or plastic. However, they should be considered a novelty or a temporary solution as they are not as secure as other storage methods.

Tax Implications of Cryptocurrency Gifts

Cryptocurrency gifts are usually not taxable unless the transfer exceeds the gift tax allowance. The IRS only needs to be alerted when the asset is eventually sold by the recipient and a capital gain or loss is realized. The annual exclusion is $16,000 for tax year 2022 and increases to $17,000 for tax year 2023.

Choose Right Cryptocurrency

When gifting cryptocurrency, it’s best to settle on mainstream, well-established options like Bitcoin, Ethereum, or Solana. Cryptocurrencies are high-risk investments, and prices can swing wildly from one day to the next. Therefore, it’s essential to review your options before buying and consider what the recipient might want.

Conclusion

Gifting cryptocurrency can be an exciting and potentially versatile gift. With an increasing number of e-commerce companies accepting digital assets as a payment method, they can be used to shop and pay bills. Plus, they could be worth a lot more in a few years.