Bitcoin is traded on various exchanges worldwide. One common question among investors is how to buy Bitcoin using a credit card. This article provides a step-by-step guide on this process, what you need to open an exchange account, and factors to consider when purchasing Bitcoin with a credit card.

How to Buy Bitcoin With a Credit Card

Purchasing Bitcoin with a credit card is relatively simple. However, several factors need to be considered, including the type of credit card and whether your chosen exchange supports it.

Steps Required to Buy Bitcoin With a Credit Card

The process of buying Bitcoin with a credit card follows a specific sequence:

Step 1: Research the credit card

Before planning to purchase Bitcoin with a credit card, research the card and payment company. Not all credit cards support Bitcoin purchases. Some that do include American Express, Mastercard, Visa, and SoFi.

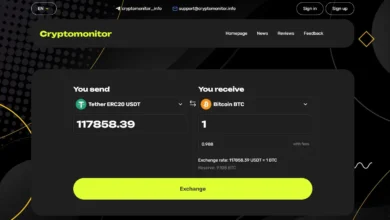

Step 2: Research the exchange

While some exchanges support Bitcoin purchases using credit cards, others may not. Even if an exchange allows credit card purchases, the process might not be instant due to fraud prevention measures. Therefore, it’s crucial to research which exchanges support your credit card. Some popular exchanges that accept credit cards for Bitcoin purchases include Binance, Kucoin, and Revolut.

Step 3: Link the credit card

After finding a suitable exchange, verify your account by providing personal information to meet know-your-customer (KYC) requirements. Then, link your credit card to the exchange by clicking “add new card” and entering your full name, card number, CVV, expiry date, and billing address.

What You Need to Open an Exchange Account

Opening an exchange account requires certain information and steps. For decentralized exchanges, the process involves downloading the software or browser extension, setting up an account, and storing your recovery phase.

For centralized exchanges, you must meet the KYC verification requirement before funding your account and trading. The necessary information includes your full name, a form of identification like a passport, proof of address such as utility bills, Social Security number, and other details as required by the exchange.

Each exchange also has a minimum deposit requirement. For instance, Coinbase and Binance require users to deposit at least $50 and $10, respectively, to complete their trades.

Factors to Consider When Purchasing Bitcoin With a Credit Card

When buying Bitcoin with a credit card, it’s important to consider the fees associated with each card. Each card charges unique fees, so researching these can provide insight into the costs involved. Additionally, remember that not all exchanges accept credit card purchases, and those that do may have a validation process to prevent fraud.

Frequently Asked Questions (FAQs)

How can I buy Bitcoin with a credit card?

Buying Bitcoin with a credit card involves entering your credit card number, CVV, and expiration date on an exchange’s checkout page. However, it’s important to first research the type of credit card you have and whether the exchange supports it. Credit cards that support Bitcoin purchases include American Express, Mastercard, Visa, and SoFi.

What are the steps to buy Bitcoin with a credit card?

The process involves three main steps. First, research your credit card and payment company to ensure they support Bitcoin purchases. Second, research the exchange to confirm if it allows Bitcoin purchases using credit cards. Some popular exchanges that accept credit cards include Binance, Kucoin, and Revolut. Lastly, link your credit card to the exchange by providing your full name, card number, CVV, expiry date, and billing address.

What do I need to open an exchange account?

To open an exchange account, you’ll need to provide personal information such as your full name, a means of identification like a passport, proof of address such as utility bills, and your Social Security number. This is to meet the know-your-customer (KYC) requirements mandated by regulatory authorities. Additionally, each exchange has a minimum deposit requirement. For instance, Coinbase and Binance require users to deposit a minimum of $50 and $10, respectively.

What factors should I consider when purchasing Bitcoin with a credit card?

Before purchasing Bitcoin with a credit card, consider the type of credit card you have and whether the exchange supports it. Also, research the fees associated with your card and the exchange. Be aware that not all exchanges allow instant purchases due to validation processes to prevent fraud. Finally, ensure you understand the KYC requirements and minimum deposit amounts for the exchange you choose.

Conclusion

Buying Bitcoin with a credit card involves careful consideration of the type of card, the exchange, and the associated fees. It’s essential to conduct thorough research and ensure you meet all the requirements before proceeding with the transaction.